Multnomah County taxpayers outside the Portland city limits are not subject to the Business License Tax, and Metro area taxpayers exterior Multnomah County are moreover not subject to the Preschool for All Tax or the Enterprise Income Tax. Let’s briefly break every of these taxes down, starting at the state level and becoming progressively more native. Relating To the state of Washington, sale tax has a base then plenty of add ons that aren’t accounted for here.

This implies that, on common, taxpayers pay about 6% of their revenue in state taxes, though the exact amount is decided by income level and eligibility for deductions. Oregon’s state earnings tax charges for 2025 are structured into 4 brackets, with charges that improve as revenue rises. The brackets are based on taxable revenue, which begins with federal taxable income and is adjusted for Oregon-specific additions and subtractions. The Largest contributing factor to Oregon’s low ranking for actual after-tax income is its excessive value of residing.

What’s A State Income Tax?

- By reviewing the brackets, claiming all eligible deductions and credit, and utilizing official resources, taxpayers can ensure compliance and decrease their tax legal responsibility.

- Nonetheless, it’s important to remember that not everybody pays the highest tax rate and that state income taxes don’t make up the whole picture when looking at the general tax burden.

- Single filers with an earnings between $70,000 and $100,000 can obtain as much as a $180 tax credit score when contributing at least $720.

- Portland residents could want to “Keep Portland Bizarre,” however the city’s most unrepresentative feature needn’t be its tax burdens.

- Measure 50 established the 1997–1998 most assessed worth as 90% of a property’s 1995–1996 actual market worth.

- Previously, she was a copy editing intern at NerdWallet by way of the Dow Jones News Fund internship program.

Oregon’s state earnings tax brackets vary from 4.75% to 9.9%, depending in your revenue and submitting status. For most taxpayers, state income taxes for 2024 are due on April 15, 2025. Residents of Portland must also issue within the city’s $35 arts tax, which applies to many adult residents.

How Oregon’s Many Revenue Taxes Stack

The typical Oregon home-owner pays $3,633 a 12 months in property taxes. Oregon’s state earnings tax rates and brackets for 2025 stay a central concern for residents, newcomers, and anyone considering a transfer to the state. With the 2025 tax yr approaching, it’s necessary to know what has modified, who’s affected, and what actions are required for both current and future taxpayers. This update supplies a transparent abstract of Oregon’s tax structure, current legislative developments, and sensible steps for people and households, together with immigrants and people with pending functions, to make sure compliance and maximize out there benefits.

Tax brackets for earnings beneath beneath $125,000 are indexed for inflation and adjusted yearly, whereas tax brackets over $125,000 are only modified explicitly by statute. To assist offset excessive state revenue taxes, Oregon taxpayers can deduct as a lot as $6,one hundred of Federal income tax from their Oregon taxable revenue. The 2025 state earnings tax charges and brackets apply to income earned from January 1, 2025, through December 31, 2025. Taxpayers will use these rates when submitting their returns in early 2026. It’s essential to notice that withholding and estimated tax payments all through 2025 ought to mirror these charges to keep away from underpayment penalties.

Because Oregon’s tax system is progressive, the influence varies depending on income level, submitting status, and eligibility for deductions or credits. The structure is particularly related for immigrants and newcomers, who could additionally be used to different tax methods in different states or international locations. Owners 62 and older may qualify for Oregon’s property tax deferral program. If accredited for this system, you will borrow cash from the State of Oregon to pay your county property taxes.

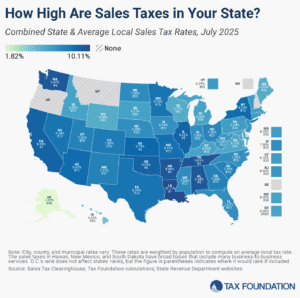

IRS Free File lets taxpayers put together and file federal revenue tax returns online utilizing guided tax preparation software program. Retail sales taxes are a vital part of most states’ income toolkits, liable for 24 p.c of combined state and native tax collections. There are 1,200 local taxing districts in Oregon, with property tax charges various between each one.

Hawaii residents pay out round 7.2% of their revenue in gross sales and excise taxes yearly. New Hampshire residents have the lowest burden—the state doesn’t cost a basic gross sales tax, and other excise taxes only work out to lower than 1% of the common resident’s earnings each year. If you reside and work in the same state, you probably need to file only one state return every year. But when you moved to another state in the course of the 12 months, lived in one state however labored in one other, or have, say, income-producing rental properties in multiple states, you may must file multiple state return. Because the price of many tax software program packages contains preparation and submitting for just one state, filing multiple state income tax returns can often imply paying further.

Oregon’s property tax system is reasonably aggressive, though the property tax burden relative to non-public revenue is greater than in California and Washington. Additionally, the state imposes an property tax with a most fee of 16 percent and the lowest estate tax exemption amongst states that levy the tax ($1 million), which additional reduces the state’s competitiveness for high-net-worth people. Oregon has a graduated revenue tax, with 4 tax brackets and ranging charges. How a lot you’ll pay is dependent upon your earnings https://www.intuit-payroll.org/, filing status, and the deductions or credit you qualify for.

Oregon has a progressive earnings tax that ranks among the many highest within the nation. The average efficient property tax fee is just below common, nevertheless, ranking 25th within the country. Oregon’s high earnings taxes are partially because of the reality that Oregon has no state gross sales tax.

The tax system both displays the prevailing economic forces of its time and helps shape economic outcomes. Nearly all states employ a statewide gross sales tax, which ranges from 2.9 % in Colorado to 7.5 percent in California. Additionally, many states enable the levying of native gross sales taxes, which are then added to the state’s tax. The tax applies to individual earnings, together with income flowing via to the house owners of pass-through businesses, but is not imposed on the entity stage. Vermont charges the most in property taxes, at 5% of residents’ revenue.